Starting From

Interest Rate

At Networth Advisory, we understand that delayed payments can disrupt your business operations. That’s why our Purchase Invoice Financing service helps you unlock the working capital tied up in unpaid invoices. Instead of waiting for your buyers to clear payments, get instant access to funds and keep your business running smoothly.

This flexible financial solution allows you to manage cash flow efficiently, pay suppliers on time, and grab new opportunities without any delays. Whether you’re a small enterprise or an established firm, our customized financing options are designed to meet your unique business needs.

Partner with Networth Advisory today and experience hassle-free funding that empowers your growth — without adding debt to your balance sheet.

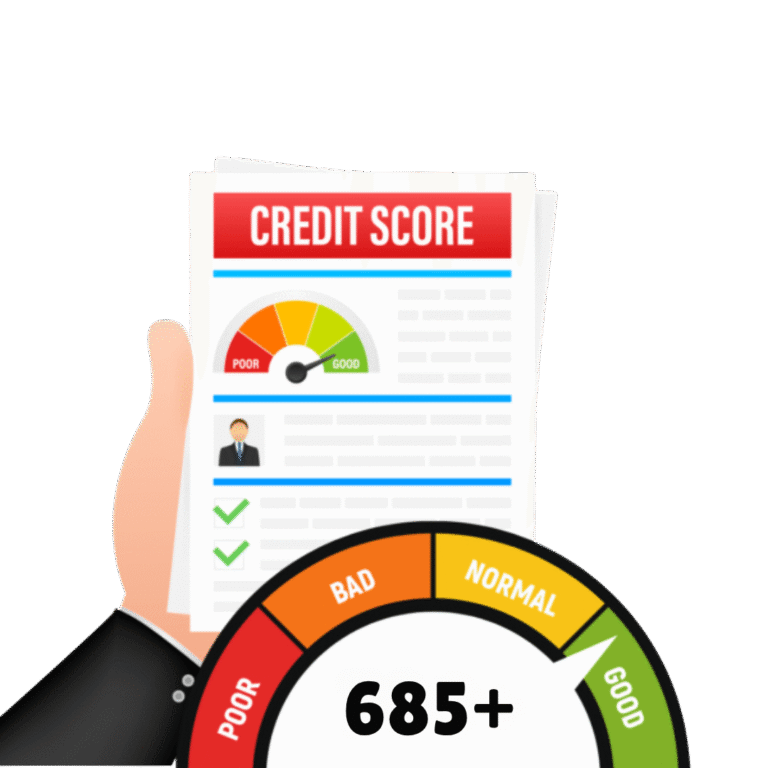

If your business has a turnover of ₹15 crore+ and a CIBIL score of 685 or above, Networth Advisory offers a reliable solution: Purchase Invoice Financing ranging from ₹50 lakhs to ₹3 crore+. This facility is specially designed for manufacturers, traders, and contractors who need quick working capital without waiting for client payments.

We provide this financing through our trusted partner, Aditya Birla Capital, ensuring a smooth and secure process. Whether you need to purchase raw materials, fulfill large orders, or pay suppliers on time — this funding helps you maintain momentum without disrupting your cash flow.

At Networth Advisory, we focus on fast processing, minimal paperwork, and personalized support — so you can focus on running and growing your business. With purchase invoice financing, you’re not just managing expenses — you’re unlocking growth.

There are 3 key players in the Purchase invoice financing process:

A drawer is a company or a Seller that sells goods or services to its clients and is entitled to receive money at a later date.

A drawee is the purchaser of goods or services, responsible for making a future payment in exchange. Esentially, the drawee is the debtor of the drawer, on whom the bill of exchange is issued.

A payee refers to the individual or entity that receives the payment. When the drawer negotiates the bill with a bank or non-banking financial company (NBFC), the bank or NBFC assumes the role of the payee.

It’s a loan facility where you can get funds against your purchase invoices — without waiting for client payments. It helps you manage raw material purchases, supplier payments, or large orders smoothly.

No, this facility is available for businesses with a turnover of ₹15 crore or more and a CIBIL score of 685+. It is specifically designed for manufacturers, traders, and contractors.

Networth Advisory arranges this financing through Aditya Birla Capital — offering a fast and secure process in partnership with a trusted NBFCs.

You can get funding from ₹50 lakhs to ₹3 crore+, and the process is usually very fast, with minimal documentation required.

Networth Advisory is a new-age financial services platform that brings lenders and borrowers together for a seamless and fuss-free loan disbursal experience. We are associated with the reputed Banks and Non-Banking Financial Companies (NBFCs) in the country. We offer competitive and reasonable loan interest rates.

Read more

Copyright 2025 | Networth Advisory