Minimum

Interest Rate

A form of Business financing with poor CIBIL

given by a lender to a firm without the need for collateral or security is known as an unsecured business loan.Unsecured business loans are given out based on the creditworthiness and financial stability of the company and its owners, as opposed to secured loans, which are backed by assets like real estate, machinery, or inventory.

A low CIBIL unsecured business loan is a type of financing provided to entrepreneurs or small business owners without the need for collateral. Unlike traditional loans, where the lender evaluates your creditworthiness based on your CIBIL score, unsecured business loans for low CIBIL scores focus more on the potential of your business, cash flow, and repayment capability rather than just your credit history. These loans offer much-needed capital for businesses struggling to meet the traditional credit score requirements.

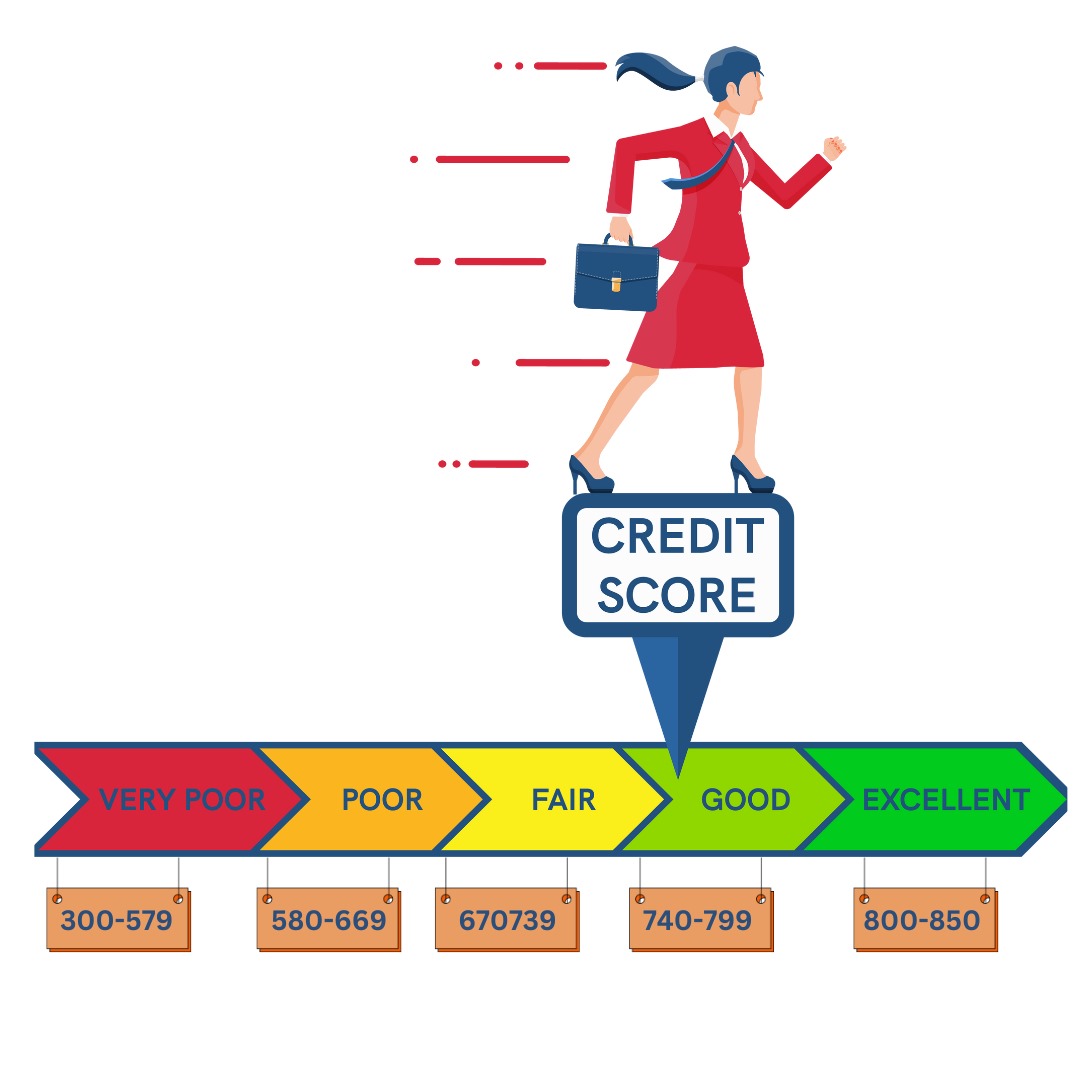

A Credit score is a three-digit number that reflects your creditworthiness based on your credit history. Typically, this score ranges from 300 to 900, with higher scores indicating better creditworthiness. A low CIBIL score, generally considered below 650, signals poor credit management or past financial difficulties. This can make it challenging to secure loans or credit cards and often results in higher interest rates or stricter terms if credit is granted.

Low credit score business loans that is below a specific level and indicates a higher likelihood of defaulting on financial commitments is referred to as having a low CIBIL score. One of the top credit bureaus in India is CIBIL (Credit Information Bureau (India) Limited), which evaluates a person’s creditworthiness using their financial behavior and credit history.

At low cibil unsecured business loans are often more accessible than secured loans because they do not require collateral. This can be advantageous for businesses that lack significant assets to pledge as security.

The approval process is typically faster compared to secured loans since there’s no need for collateral evaluation. This means you can access funds more quickly to address immediate business needs. Fast unsecured business funding

Whether it’s for working capital, expansion, inventory purchase, marketing, or other business purposes, you have the freedom to allocate the funds as needed. Special Business loans without collateral

It does not require collateral, and your business assets are not at risk if you default on the loan. This provides peace of mind and allows you to focus on growing your business without the fear of losing specific assets.

Successfully repaying an unsecured business loan can help improve your business’s creditworthiness over time. Timely payments can positively impact your credit score, making it easier to qualify for future financing at more favorable terms.

Unlike secured loans, unsecured business loans do not require the valuation of assets, which can save time and expenses associated with appraisal fees.

Networth Advisory is a new-age financial services platform that brings lenders and borrowers together for a seamless and fuss-free loan disbursal experience. We are associated with the reputed Banks and Non-Banking Financial Companies (NBFCs) in the country. We offer competitive and reasonable loan interest rates.

Read more

Copyright 2025 | Networth Advisory